It has been said that the next wave of $1B+ companies in the cryptocurrency sector will be data and analytics firms.

Within this market, I wanted to have a better understanding of all of the data providers within the Bitcoin and crypto sector. Most importantly to better understand all of the various sources people consume data regarding the crypto market.

Unlike the traditional financial markets, most of the underlying data is public within the Bitcoin and cryptocurrency ecosystem. This leads to a unique development where there is a large and growing consumer & institutional demand for data within the cryptocurrency market.

Below is a quick primer on crypto data and an overall landscape into the data & analytics space today.

Primer on Crypto Data

One of the most interesting things about the crypto space, is the overwhelming majority of data is public. For example, on the Bitcoin network, every single transaction from the beginning of time (genesis block) until now, is recorded on the Bitcoin blockchain.

This includes every transfer between people, between exchanges, to service providers, and to merchants. Any amount of value that has moved from one address to another is recorded for all time on the Bitcoin blockchain. The same is true for most other blockchain networks out there as well: Ethereum, Litecoin, XRP, etc.

Because all data is recorded on the blockchain, this creates an interesting dynamic where all of the most valuable economic data for the $250B cryptocurrency industry, is hiding in plain sight. Unlike the traditional finance system, if you have a question about Bitcoin, you can most likely find the data to answer your question.

Companies within the data and analytics market aim to pull together all of this public data to help participants (consumers, funds, exchanges, miners, etc) make sense of the crypto market.

Data Sources

Mohamed Fouda lays out that the majority of data about crypto comes from three primary sources:

Exchange Data (Spot markets, derivative markets, OTC)

Blockchain Network Data (block explorers, hashrate, supply schedules, etc.)

Off-Chain Data (github, nodes, clients, community channels)

All of this data is largely public, especially anything recorded on the various Blockchains. The few sources that are not inherently public are:

Over the Counter (OTC) trading information

Exchanges (spot and derivatives) - Prices, order books, volume information, etc. are largely public however anything to do with user, demographic, or geographic data is more difficult to derive.

Off-Chain data is not necessarily public; however, most of the underlying sources are for the most part easy to pull (github, reddit, twitter, telegram, etc.).

Who consumes blockchain data?

Everyone in the crypto ecosystem consumes some form of blockchain data, including but not limited to:

Consumers - To check prices of Bitcoin and various cryptocurrencies.

Traders - Pulling data to build trading models.

Consumers - To confirm transfers via block explorers.

Exchanges - Reconciling & tracking the flow of funds.

Hedge funds - Pulling data for arbitrage, etc.

Institutional investors - Reconciling pricing data for bookkeeping.

Miners - Monitoring hashrate & profitability.

Regulators - Monitoring suspicious activity.

Journalists - Researching the source of truth.

DApp developers - Monitoring app usage and statistics .

Because blockchain data is inherently public, all kinds of participants can now see and utilize the underlying financial & network data within the crypto ecosystem.

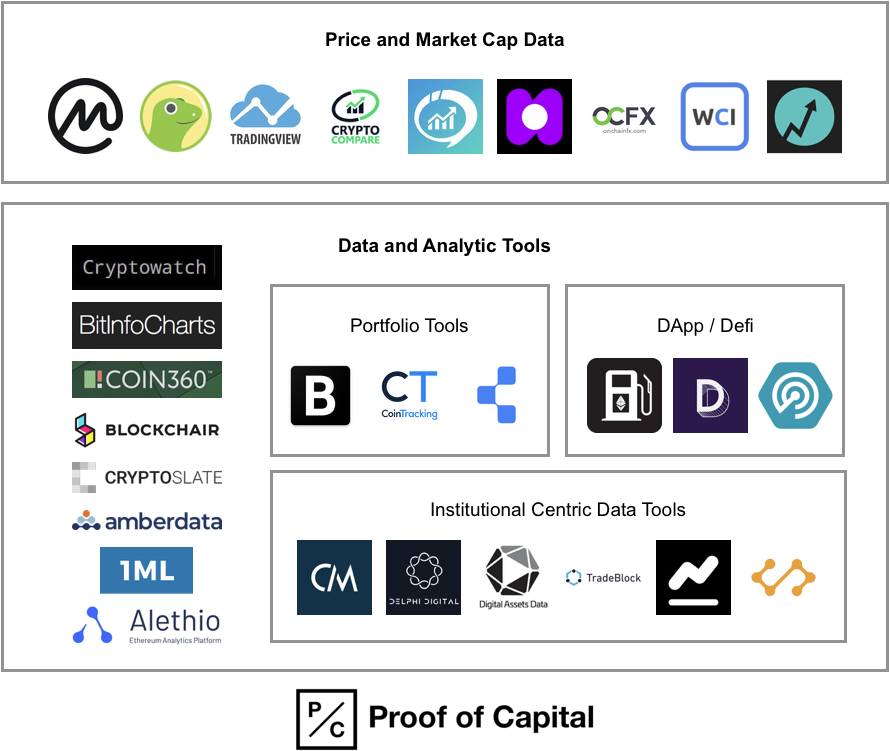

Market Ecosystem Map

Below is an ecosystem map of the data and analytic providers within the whole crypto ecosystem. I also attempted to categorize all of the companies based on the core activities they provide (some of these companies provide many services all in one).

Please tweet at me @mccannatron if:

I missed any major sources of information (particularly regional providers)

If you feel I have have mis-categorized any company in particular.

If there are any other companies we should consider adding.

The visual market map has a truncated list of companies, with the full listings of all the companies within each category below: